Signing a commercial lease agreement in California is an essential step for you as a business owner. Whether you're opening a shop, going into an office space, or renting out facilities for a product, at some point, you're probably going to have to save a space for your business. Once you've found that space, signing the agreement could seem like an annoying final step before you can get moved in and focused on managing your business. But like most legal lease agreements, a California commercial lease is an important document that requires some study.

What is the California Commercial Lease Agreement?

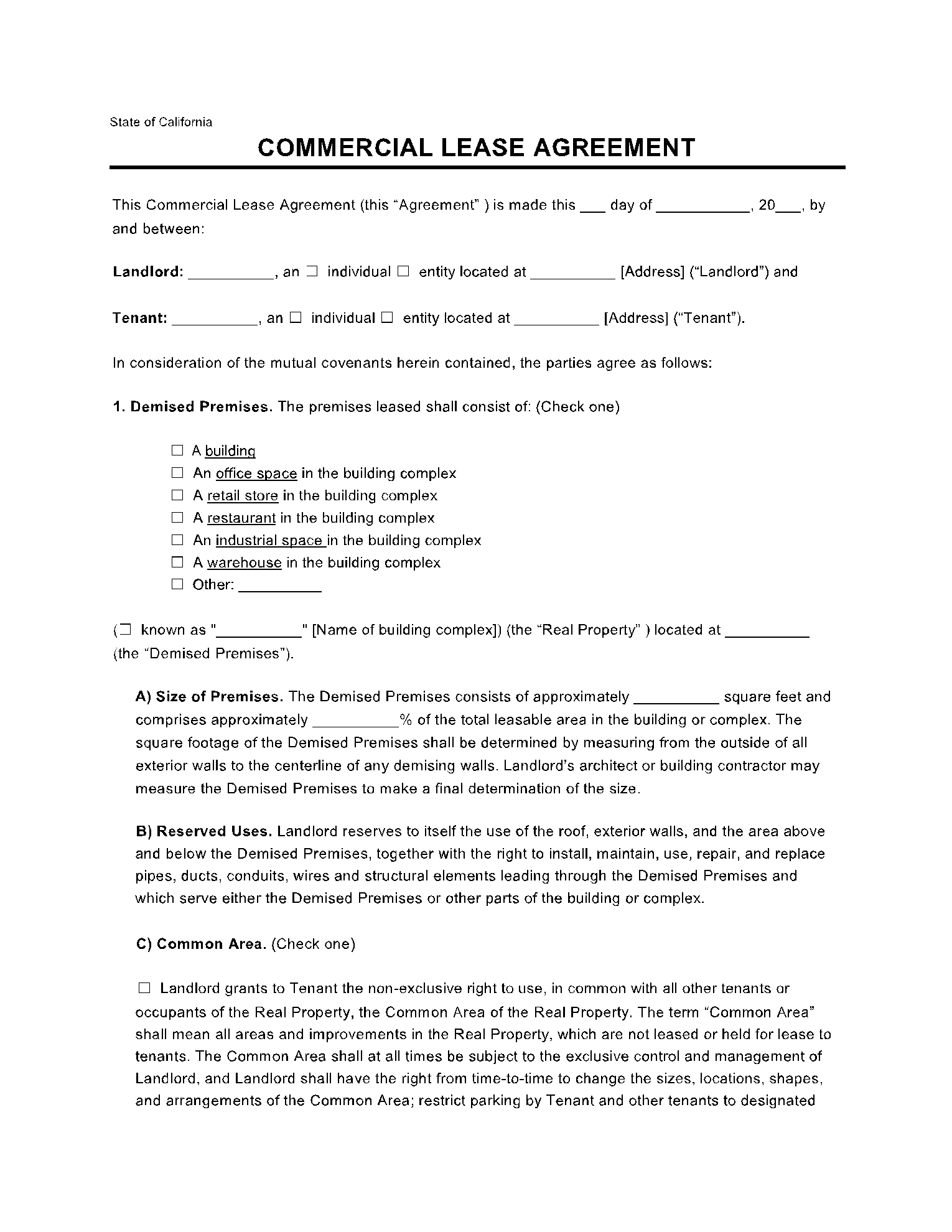

A commercial lease agreement in California acts as a binding agreement between a landlord leasing commercial space to a tenant running a business from that space and the tenant renting the space. The parties to this agreement must assure to have their facts straight as the character of the business may require some extra governing things.

The agreement itself will have a wise financial effect on both the landlord’s finances and the tenant’s capacity to run a successful business, therefore, each party must make sure they agree with the terms of the California commercial lease. Similarly, both parties are held liable for living up to what they admitted to. Thus all the data input must be %100 true.

Elements of a Commercial Lease Agreement

A commercial lease agreement in California is a contract, so it is necessary to include certain elements and key information for it to be true and enforceable. At a minimum, information about the rent, security deposit, lease duration and any extra costs the tenant may be subject to should be defined in the lease.

The 'other charges' category is an important data field that should be carefully reviewed" before you sign the California commercial lease agreement. Property taxes, building insurance, and maintenance costs fall under the 'additional costs' tree. These additional expenses can instantly tally up to high overhead costs.

Writing a Commercial Property Lease Agreement

If you are leasing commercial space in California for a local shop, office, or other business, make sure your California commercial lease includes these common details.

- Rent - Dedicate a particular part of the lease agreement to the rent on the property. Provide the rent amount, how it will be paid, and information about late payment fees.

- Security Deposit - Include the amount of the security deposit and when it is to be paid.

- Utilities and Amenities - Outline which utilities are the liability of the tenant and which are to be given to be the landlord.

- Renovation and Improvements - Outline what types of changes and renovations to the property the tenant is permitted to do. If the landlord intends to make changes upon request from the tenant, this part can also be used to outline the process for submitting a request to update the space.

- Repairs and Maintenance - In California, the necessary improvements to make a property inhabitable are the liability of the landlord and should be made quickly once the landlord has been notified. Other improvements of non-essential things may be the liability of the tenant.

- Subletting - Assign a section outlining if and under what situations the renter is permitted to sublet the property. If subletting is allowed, outline what duties will fall to the tenant.

- Illegal Activity - Add a legal disclaimer on performing illegal activity on the property. Most landlords choose to keep the right to end the lease immediately if illegal activities are found.

- Terminating and Renewing the Lease - Mention the process for ending the lease, as well as renewing it when the current lease is up. Discuss your local laws and policies when writing this part, as there may be rules governing when and how notice may be given.

Conclusion

Commercial leases can be complicated. Normally, commercial leases are three to five years long. In the long term, keeping a commercial property is typically more cost-effective than leasing. Leases are still popular because many businesses can't devote an important part of their capital to commercial real estate.